Insights

INSIGHTS

All Topics

My Account

The future of charity finance

21 Jun 2021by Aidan Paterson

In recent years, the corporate world has altered its perception of finance, and come to regard it as a strategic enabler. However, many charity leaders still view finance as more of an historical administrative and compliance activity. We explore what a change in mindset could mean for the sector

A 2017 report published by Deloitte identified that corporate leaders see the changing role of finance as transitioning towards becoming a strategic enabler, leading to growth, innovation and transformation for their organisations.

By a strategic enabler we mean something that helps an organisation to execute its strategy more efficiently and effectively. When applied to a charity this would be actions that align the organisation more closely with its objectives.

In the past few years, this concept has picked up steam in the corporate world: an increased number of corporate organisations have embraced the potential of finance to grow the core business. Through a process of digitisation, finance workers can deliver more valuable insights and optimise processes, which helps the organisation to become more efficient and maximise return on investment.

Yet charities have been slow to adopt this mindset. The sector simply hasn’t undergone the same process of transformation.

Why is this? The simplest answer is that a charity’s aims are different to that of a business or other for-profit venture. There has not been sufficient effort dedicated to exploring the implications of this trend in the not-for-profit sector.

Transitioning the finance function to the role of strategic enabler could unlock unique benefits for a charity – specifically, it can enable a charity to maximise its impact and deliver better, more efficient services to its beneficiaries.

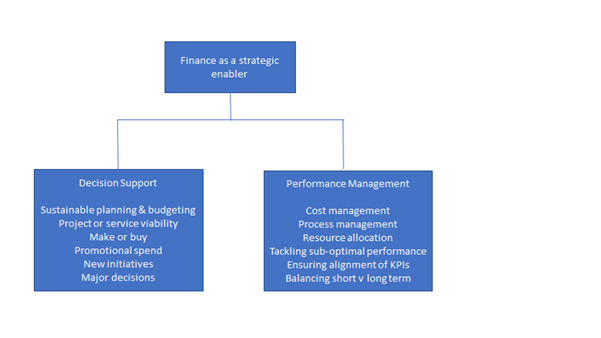

In short, this would focus on how finance can help the NPO to maximise its impact. Logically these break down into two main areas: decision support and performance management.

Decision support enables leaders to make sustainable financial choices

Decision support refers to any system of information that supports business or organisational decision-making activities. One example of this might be a charity using CRM data to make more informed decisions about their service users’ needs.

Good decision support is vital to achieving strategic objectives because it enables leaders to take the right steps forward at any point in time, while knowing they are affordable and help the NPO respond to changing circumstances without abandoning their focus.

A budget is vital, as it allows a charity to produce a fully costed plan for the year ahead. The plan will show exactly what charitable activities it wants to perform (which will define its impact), the cost of delivering those activities, and the income that funds them.

This budget will enable timely decisions to be made about any cost saving measures that might be required, as well as specific fundraising activities. It will also provide the basis for performance management through the year.

When launching any new service, the full costs of providing that service need to be understood and planned for. This will need to go beyond the cost of provision to include other areas such as any facilities costs, travel expenses, IT costs, and any costs associated with promoting the service and monitoring its impact.

For a new service, there are also likely to be the costs of getting started, which might include recruiting new staff, designing the new services, any compliance costs (e.g., Disclosure and Barring Service checks). This full understanding will be vital to ensure that the service can be financed – whether it be through a commissioner (government, NHS, etc.), grant provider or through other fundraising initiatives.

Make or buy decisions are common across many organisations. This might relate to a new website where the decision might be whether to buy and configure an existing solution from a supplier such as Wix or to have a custom build from a web design agency. Finance can support decision-making by looking at the full costs of each option, which will include far more than the initial agency or package acquisition cost – such as all maintenance costs and the costs of staff time both for initial deployment and lifetime support. Make or buy decisions might also apply to new services – they could be provided in house or by a contracting a third party.

Mergers are one of the biggest decisions many charities will face. The logic of a merger is to increase the impact of two charities by combining resources. There are typically opportunities to save on overheads (reduce the number of offices and administrative staff) and fundraising costs.

However, there are risks. Sometimes mergers are driven by the impending failure of one organisation. But without a full understanding of the finances of both organisations and the future combined organisation, there is the risk that financial weaknesses in one organisation might pull down both. There are also significant costs associated with a merger – the largest of which will be staff time. But these costs will also include some third-party finance and legal costs. These costs need to be planned for and can change an initially attractive merger into one that delivers no incremental impact to the charity’s beneficiaries.

Performance management keeps organisations on track to achieve objectives

While decision support focuses on key points in time, performance management is also a vital part of ensuring that a charity meets its strategic objectives.

The simplest form of this is monitoring performance against the budget. This will enable variances to be identified and studied with the aim of taking any corrective actions. So, if there is over-spend on energy, can switching to a new provider save money? If travel costs are too high, can these be reduced by either better planning or by replacing some visits with phone or video calls? And if costs can’t be reduced, can the over-run be funded through other means, such as a new fundraising promotion, commissioners or even from reserves?

Performance management is also important when it comes to ensuring that a charity meets its financial commitments. This is most pertinent regarding the correct management and appropriation of restricted funding, which in turn will determine the levels of funder confidence that shape future strategy and decisions around income generation through project-related grants.

Performance management can also focus on other areas including understanding the costs of different processes and using this knowledge to help improve them; helping to decide where and how to allocate scarce resources (e.g., use of buildings, expert staff time) and keeping the short term and long term in balance (e.g., using reserves to buffer short term budget gaps and then rebuilding them in times of surplus).

Positioning finance as a strategic enabler within your organisation

At the most simplistic level, finance’s most obvious functions remain essential to the continued operation of any charity.

Accounts have to be filed with the relevant authorities or charitable status can be removed; expenses, bills, and salaries need to be paid in the normal course of operations; and the books need to balance or the organisation will run out of money and have to shut down.

However, there is a considerable difference between simply continuing to operate and fulfilling the organisation’s strategic goals.

This difference would be present in any sector. But it is even more pronounced for charities who will have publicly stated charitable aims. Simply existing isn’t enough – a charity should be maximising its impact and exploring any credible means of doing so. Positioning finance as a strategic enabler had the potential to achieve this increase in impact.

Sage Foundation and Charity Digital have developed a framework of Organisational Financial Literacy (OFL) that takes a charity from bookkeeping through accounting and financial management to financial planning and analysis.

As the financial capabilities of charities move up through the levels of the model their strategic contributions to their organisations will increase.

Find more resources

Find more charity finance resources at the NPO Success Hub

Aidan Paterson

More on this topic

06 Feb 2025by Laura Stanley

Webinar: From legacy to leading – How to switch to a new finance system stress-free

Related Content

Recommended Products

06 Feb 2025by Laura Stanley

Webinar: From legacy to leading – How to switch to a new finance system stress-free

Our Events

Charity Digital Academy

Our courses aim, in just three hours, to enhance soft skills and hard skills, boost your knowledge of finance and artificial intelligence, and supercharge your digital capabilities. Check out some of the incredible options by clicking here.